The bustling city of Bengaluru isn’t just a hub for tech startups—it’s also a growing hotspot for aspiring stock traders. Whether you’re a beginner dipping your toes into the Indian stock market or an experienced trader aiming to master futures and options, forex trading, or refine your strategy, enrolling in the right stock trading course in Bangalore can be your gateway to becoming a Pro Trader. With quality stock market training in Bangalore, you gain the practical skills and insights needed to navigate today’s fast-paced financial markets confidently.

But with a myriad of options available, how do you choose the one that will help you trade smarter and more profitably?

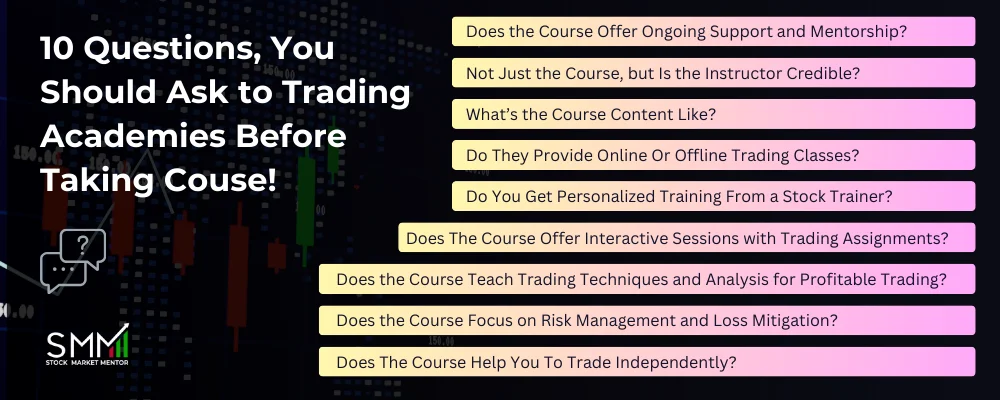

Cost is important, yes. Reputation matters, of course. But before you hand over your hard-earned money, these are 10 essential questions to ask before enrolling in a stock trading course in Bangalore to ensure you get the knowledge, guidance, and hands-on experience you need for profitable trading.

Table of Contents

What Are The 10 Questions To Ask Before Taking Stock Trading Course in Bengaluru?

1. Not Just the Course, but Is the Instructor Credible?

While selecting the course that is aligned with your learning objectives is important, choosing the right instructor is more crucial as it will make or break your learning experience.

When you review the instructor’s profile, ask yourself these questions.

- What is their experience in the stock market?

- Do they have a track record of profitable trades or successful investments?

- Do they hold any relevant certifications?

An experienced instructor like Stock Market Mentor can help you understand stock market trading with their valuable insights and unique techniques that are beyond the course material.

Also, credible sources, such as Investopedia, provide a wealth of information on how to assess the credibility of financial mentors and institutions. If you’re evaluating mentors, check out insights from our guide on types of investors to align your learning style with the right trading philosophy.

2. What’s the Course Content Like? Is It Just Basic, or Does It Cover Advanced Trading Topics?

Some courses only cover the stock market basics, terminologies, or technical indicators, just scratching the surface. But if you want to be a successful trader, you need to go beyond the basics. The best trading classes will cover everything from fundamental share analysis to advanced concepts like analyzing stock market charts, options trading, futures, and risk management.

You can check out our The Value Investor course to learn fundamentals to advance trading topics & strategies.

At Stock Market Mentor, the curriculum is designed to take you from beginner to pro. Here, you can learn how to spot trends, set stop-loss orders, or execute complex trades, and you’ll walk away with the tools needed to trade profitably. You can also explore our in-depth article on the 10 Advantages of Stock Trading Course in Bangalore to understand how structured training transforms beginners into professionals.

3. Do They Provide Online Or Offline Trading Classes?

This is one of the first decisions you’ll need to make.

Do you prefer the flexibility of online learning, or would you rather be in a classroom with a live instructor to ask questions on the spot?

Both formats have their pros and cons, and what matters most is finding the right stock trading courses in Bangalore that work for your learning style and schedule.

For those who don’t have access to quality in-person training in their city, online trading courses allow you to learn at your own pace, on your own time.

To know more, check out Classroom vs Online Stock Market Courses to evaluate which model suits you best.

4. Do You Get Personalized Training From a Stock Trainer?

If you’re serious about learning to trade, you need more than just generic stock training. Look for courses that offer one-on-one sessions or personalized guidance.

This is especially important if you’re new to stock market trading, as personalized feedback helps ensure you’re absorbing the material properly and applying it to real trades.

Consider stock trading courses in Bangalore that offer personalized training, as this helps you gauge how well you’re grasping concepts and implementing strategies. With Stock Market Mentor, you will get individual attention to help you succeed. Check out our Pro Trader Course which offers exclusive trading classes with personalized & One to One sessions.

5. Does the Course Include Live Market Analysis?

Stock market trading is not about perfect charts and shiny graphs. It’s messy, unpredictable, and full of surprises. That’s why you need a course that isn’t just theoretical or based on perfect “what-if” situations. Instead, look for a course that shows you how to analyze stocks and execute trades during market hours.

Courses like the ProTrader Course or Futures and Options Trading Course offer live market examples, giving students a first-hand look at how the strategies work in real-time situations. This is exactly how you get a feel for how markets fluctuate and how to react accordingly.

6. Does The Course Offers Interactive Sessions with Trading Assignments?

In any stock trading course, you can’t learn just by sitting idle, taking notes, and hoping it sticks. You need to roll up your sleeves and get involved. Look for a course that pushes you to apply what you’re learning through interactive sessions and assignments. After all, you can’t really know something until you’ve tried it yourself.

Assignments are a great way to test your knowledge and identify what you’re still struggling with. Stock trading courses in Bangalore that encourage participation, ask you questions, and push you to think critically will help you understand the material much more deeply. You want a course that’s hands-on and challenges you to grow. The more you engage, the faster you’ll learn!

7. Does the Course Teach Trading Techniques and Analysis for Profitable Trading?

When it comes to stock trading, the ultimate goal is, of course, profitability. But how do you get there? It’s not just about buying and selling, it’s about knowing which stocks to pick, when to enter the market, and how to exit with a profit.

Look for stock trading courses in Bangalore that cover strategies like technical analysis, chart patterns, and trend analysis. These tools are essential for identifying profitable trades.

A good trading course will teach you how to read stock charts, spot trends, and use indicators like moving averages or RSI (Relative Strength Index) to determine when to enter and exit a trade.

8. Does the Course Focus on Risk Management and Loss Mitigation?

Let’s face it, losses happen. When the market gets rocky, you need to know how to protect your capital, not just find opportunities to profit.

Risk management and risk assessment is key. You’ll want to learn strategies like setting stop-loss orders, diversifying your portfolio, and calculating risk-reward ratios. Knowing these techniques will help you stay cool when things aren’t going according to plan.

Take the 2008 stock market crash for example, traders who had solid risk management strategies in place, like using stop-loss orders, were able to minimize losses while others were left reeling.

A good course will teach you how to make well-informed decisions that keep your risk in check, no matter how the market behaves.

9. Does The Course Helps You To Trade Independently?

A great stock trading course does more than just teach you the basics, it helps you become a self-sufficient trader.

By the time you finish, you should feel confident enough to make your own decisions. The ultimate goal is for you to learn how to evaluate stocks, analyze market trends, and determine your next move without constantly relying on someone else’s guidance.

After completing a quality course, you should be confident enough to assess a stock, predict its movement, and know when to pull the trigger on your own terms.

10. Does the Course Offer Ongoing Support and Mentorship?

When it comes to stock trading, the learning doesn’t stop when the course ends. Continuing support and mentorship can be a game-changer in your trading journey.

Some courses offer lifetime mentorship, which means you’ll have ongoing access to your mentor or a community of traders for feedback, advice, and inspiration long after the course wraps up.

Having this support system can help you stay on track and avoid common pitfalls as you progress. Continuous mentorship can help you with a tricky trade or new market trends, in turn helping you become a successful trader.