Option trading is simple until you try it. Most retail traders lose money because they don’t understand how to price options, manage volatility, or control risks. Blindly relying on tips, rumors, or half-boiled information results in money loss and confidence crashes. That’s where a structured and strategy-focused program steps in.

The FNO Champion course by the Stock Market Mentor is the Best Options Trading Course in India for those seeking not just theory but consistent execution in the options market.

In this article, you’ll get to know the course objective, features, details, and curriculum.

Growing Popularity of Options Trading Course in India

Over the past few years, options trading has seen a major upswing in India. With the rise of mobile trading platforms, better internet access, and increased financial literacy, more retail investors are entering the derivatives market than ever before.

This trend is due to:

- Lower capital requirement compared to equity delivery.

- Flexibility to trade in rising, falling, or sideways markets.

- Availability of weekly and monthly contracts that suit different trading styles.

Plus, with more educational content available and SEBI encouraging transparency, people now feel more confident exploring options as a wealth-building tool.

Why You Need a Structured Options Trading Course?

An options trading course isn’t just about buying low and selling high, it’s about strategy, timing, and discipline.

If you are new to trading, you might get overwhelmed by complex charts, confusing jargon, and inconsistent results without proper guidance.

A structured options trading course gives you a roadmap. It helps you to:

- Understand how the options market truly works beyond surface-level tips.

- Learn proven strategies like straddle, strangle, and iron condor, and when to apply them.

- Avoid common mistakes that cost beginners money.

- Build confidence to trade in both bullish and bearish markets.

More importantly, a well-designed course helps you develop a trader’s mindset, backed by data and risk management.

Instead of guessing your next move, you’ll be taking strategic trades, supported by practice and mentorship.

Stock Market Mentor’s Option Trading Course In India: Quick Overview

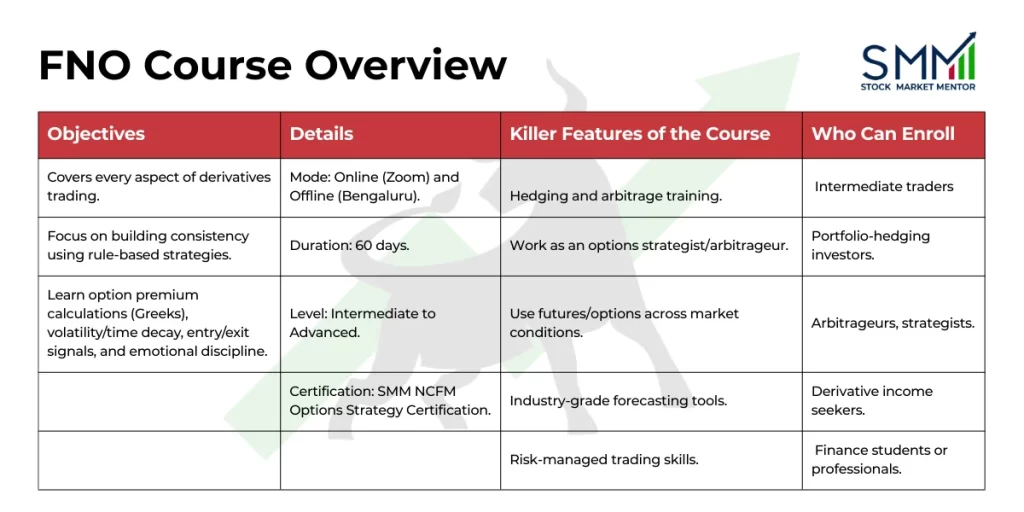

The FNO Champion course by Stock Market Mentor is a professional-grade, strategy-driven program curated for traders who want to understand the real mechanics of options and futures trading. Here’s a quick overview of the course.

1. Main Objective of the FNO Course

The FNO champion course is designed to cover every aspect of derivatives trading from understanding the fundamentals to mastering high-probability strategies. This course is exclusively for traders who want to build consistency using rules and not guesses.

By the end of the course, you’ll know:

- How option premiums are calculated using Greeks.

- The importance of volatility and time decay.

- When to buy and sell options based on entry/exit signals.

- Rule-based strategies to reduce emotional trading errors.

2. Details of FNO Championship Course

SMM’s option trading course offers flexible learning and focused results to students.

- The course is available in both online (live Zoom classes) and offline (at Bengaluru) modes.

- The course duration is 60 days.

- It is designed for intermediate to advanced-level learners.

- Upon successful completion of the course, the participants receive the SMM NCFM Options Strategy Certification. This credential adds credibility if you’re seeking roles in finance or consulting.

3. Killer Features of This Option Trading Course

We designed this course to deliver practical skills that matter in real-time trading.

Key benefits include of the Future n Options Champion Course –

- Learn hedging and arbitrage in derivatives.

- Understand how to work as an options strategist or arbitrageur.

- Use futures and options in combination across market conditions.

- Learn with industry-grade forecasting tools.

- Explore employment assistance in arbitrage businesses.

- Develop skills for risk-managed trading.

Bonus Perk: With a 90% success rate and 10k+ positive ratings, most learners have successfully applied the strategies in real trading scenarios.

4. Who Can Enroll for this Course?

This course is best for:

- Intermediate traders looking to improve strategy depth.

- Investors seeking to hedge portfolios.

- Arbitrageurs and options strategists.

- Individuals exploring derivative-based income.

- Finance students or professionals aiming for certification in options trading.

Above all, if you’re seriously interested in mastering futures and options trading, this course gives you a strong foundation to start trading.

Get Attractive Bonus with Our Option Trading Course!

Course Curriculum: What You’ll Learn from SMM’s Option Trading Course

The curriculum is packed with practical content designed to enhance your trading knowledge. Here’s how the course curriculum is structured:

1. Foundations of Derivatives and Options

- Introduction to Derivatives

- Key Terminologies in Options

- India VIX (Volatility Index)

- Option Greeks – Foundation of option pricing and strategy.

2. Hedging and Arbitrage

- Using options to hedge long/short positions.

- Payoff profiles for buyers and sellers.

- Strategies to profit from arbitrage and neutral market movements.

3. Market-Condition Based Strategies

- Directional Strategies:

- Long Call, Short Call, Long Put, Short Put.

- Volatility Strategies.

- Straddles, Strangles, Butterfly, Condor.

- Spread Strategies

- Bull Call/Put, Bear Call/Put, Combo structures

- Advanced Strateg0ies

- Strip, Strap, Collar, Covered Calls, Protective Puts.

You’ll learn all these strategies with real-use cases, backtesting, and performance analysis.

4. Technical Tools for Better Trading

- Interpreting Options Chains and Open Interest.

- Understanding Moneyness (ITM, ATM, OTM).

- Option Pricing Models and Calculations.

- Factors Affecting Option Prices.

- Put Call Ratio: Market Sentiment Analysis.

5. Get an Attractive Bonus

- Live implementation and backtesting.

- Intrinsic Vs Time Value of Options.

- Introduction to Forex for broader trading exposure.

Bottom line: You won’t just learn options trading, but also learn how to apply strategies in different market conditions. You’ll also get the knack to translate learning into real performance through live market simulations, structured strategy analysis, and feedback from expert trainers. Overall, this course will prepare you to structure trades in bullish, bearish, and sideways markets.

Next Step Ahead: Enroll for this SMM’s Option Trading Course in India

If you’ve been thinking about learning options trading but don’t know where to start, Stock Market Mentor’s 60-day options trading course is the best options trading course in India.

Whether you’re a beginner looking for clarity or an experienced trader aiming to sharpen your edge, this course delivers practical, real-world strategies backed by expert support.

Stop doing guesswork and start trading with a clear framework and strategy. Enroll today and start trading smarter.